Payment for negative impact on the environment is carried out by the operator of the facility that has a negative impact on the environment.

The object of taxation for Pavlodar Oil Chemistry Refinery LLP is the actual amount of negative impact on the environment, in the form of:

- emissions of pollutants into the atmosphere;

- discharges of pollutants;

- buried waste.

For each type of source of negative impact on the environment, the Tax Code of the Republic of Kazakhstan establishes appropriate payment rates, the amount of which the Local Representative Body has the right to increase.

Payment rates are determined in an amount that is a multiple of the minimum calculated indicator (hereinafter referred to as the MCI).

The criterion for changing the fee amount is a change in the actual volume of negative impact on the environment and an increase in the MCI.

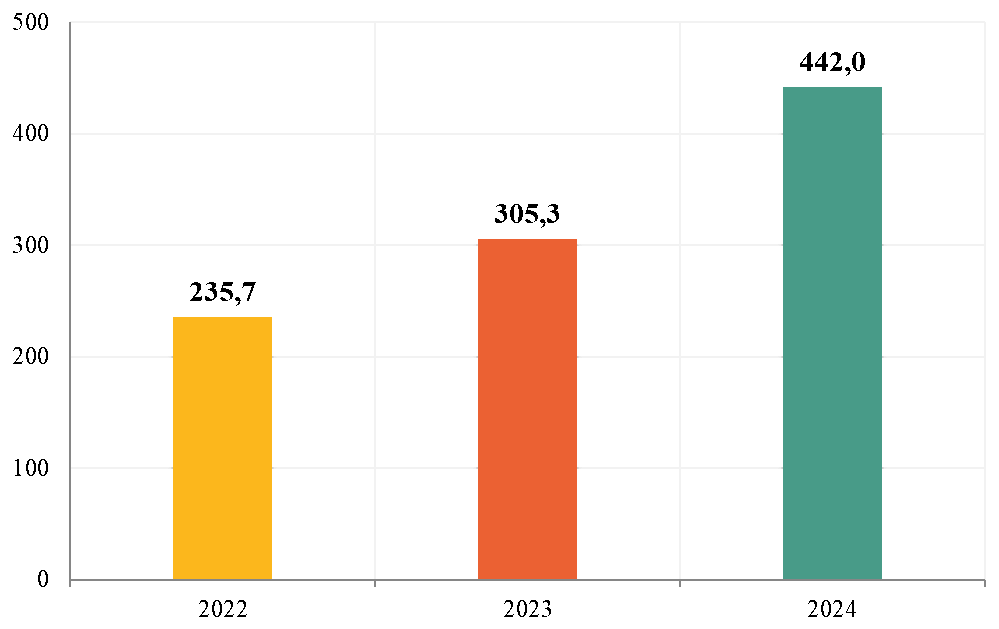

Pavlodar Oil Chemistry Refinery LLP, in accordance with the Tax Code of the Republic of Kazakhstan, makes quarterly tax payments for the negative impact on the environment to the budget of the city of Pavlodar.

|

2022 |

2023 |

2024 |

|

0,0 |

0,0 |

0,0 |